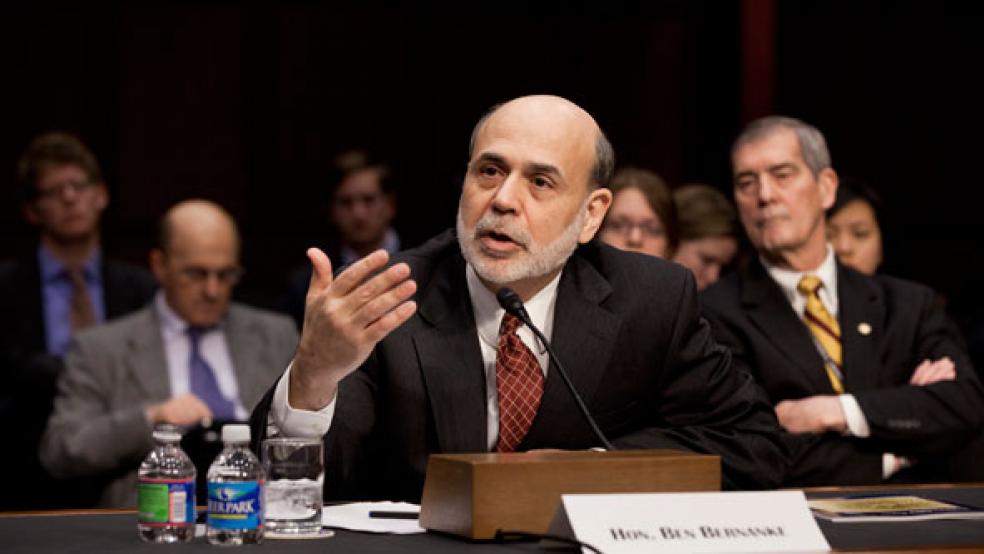

Federal Reserve Board chairman Ben Bernanke waded into the budget battles on Capitol Hill Tuesday when he downplayed the economic impact of the $61 billion of spending cuts being sought by House Republicans. The nation’s top monetary official said the Republican deficit reduction plan would lead to only a minor reduction in economic growth over the next several years.

Bernanke’s testimony contradicted recent reports from several prominent private sector forecasters, who projected the $61 billion deficit reduction plan passed late last month by the House would halve the pace of economic recovery. A confidential Goldman Sachs report sent to its clients last week estimated the House plan would knock 1.5 to 2 percentage points off gross domestic product in the third and fourth quarters of this year.

Mark Zandi of Moody’s Analytics, in a separate analysis, warned this week that the House GOP plan would eliminate 700,000 jobs by the end of 2012. After losing 8.3 million jobs in 2008 and 2009, the economy created only a million new jobs last year. Job losses of that magnitude could run the risk of sending the economy back into recession. A similar report from the liberal-leaning Economic Policy Institute earlier this year suggested a $60 billion cut in discretionary spending in this fiscal year would cost about 600,000 jobs.

“A $60 billion cut would be contractionary, but our analysis doesn’t get a number quite that high,” Bernanke said during questioning before the Senate Banking, Housing and Urban Affairs Committee. “We get a smaller impact – several tenths of GDP.”

Jobs Impact of Budget Cuts

The Fed chairman’s comments will no doubt please Republicans who have repeatedly dismissed economic analyses that suggest federal spending programs like the $700 billion stimulus program (passed by the Democratic Congress in February 2009) helped lift the economy out of recession. House Speaker John Boehner, R-Ohio, on Monday dismissed Zandi as “a relentless cheerleader for the failed stimulus.”

The House-passed plan for cutting $61 billion has been put on hold while Congress passes a continuing resolution this week to keep the government going while the White House and congressional leaders work out a final spending plan for the fiscal year that ends Sept. 30.

Bernanke sought to temper his remarks on the jobs impact of budget cuts when pressed by Sen. Charles Schumer, D-N.Y., who asked if the cuts in the House bill went too far and might undermine a still fragile recovery. “The cuts would presumably lower overall demand and have some effect on growth and employment,” Bernanke replied. But he refused to make an estimate on how many jobs would be lost through the plan.

Bernanke’s comments came after his prepared economic update, which suggested economic growth is still too weak to substantially lower unemployment – now at 9 percent – this year. He also downplayed the risk of rapid inflation despite rising oil and food prices, which he blamed on turmoil in the Middle East and North Africa, and as well as rising food and fuel demand in rapidly developing countries like China and India.

Rising oil prices “can be an inflation risk,” he said. But “at the same time, it takes money out of the pockets of consumers and reduces confidence, so we have to look at it from both perspectives. It does not yet pose a significant risk or the maintenance to overall stable inflation.” The core inflation rate does not include volatile gasoline prices, which are now over $3.30 a gallon in most parts of the country. Overall inflation remains well below the Fed’s inflation target of 2 percent on an annual basis.

On the Defense

Bernanke spent most of his morning defending his policy of buying $600 billion in government securities on the open market, which is the only option open to the Fed for providing additional liquidity to the economy when the Fed’s bank lending rate is near zero. Ranking committee member Richard Shelby, R-Ala., and other Republicans on the committee attacked the so-called quantitative easing policy as potentially inflationary and a driver of higher long-term interest rates, which have risen slightly in recent months.

“Interest rates have gone up because of future expectations of growth,” Bernanke said. “The current quantitative easy appears to have had the desired effects on markets in terms of creating stimulus for the economy. Private sector forecasts have almost uniformly been upgraded since last August” when the policy was announced, he said.

When pressed on when the Fed would begin reducing its portfolio of government securities, which would be the equivalent of raising interest rates, Bernanke responded, “Once we see the economy is in a self-sustaining recovery and labor markets are improving … This is not different from the problem central banks always face about when to take away the punch bowl. We’re quite committed to price stability. We’ll move well in advance of the time that the economy is completely back to full employment,” he said.

Some Fed officials fear extending quantitative easing beyond its June expiration date could lead to a new bubble in stock and bond prices, which have surged dramatically in the past year. Sen. Pat Toomey, R-Pa., a former bond trader, raised those concerns during the hearing.

“If you look at most indicators of equity markets, bond markets and the like, while nobody can know for sure, there seems to be little evidence of significant bubbles,” Bernanke said. “The increase in farm land prices, for example, we’ve been following that closely, and been in contact with the banks that lend to farmers to make sure they are appropriately managing that risk. I do not believe at this point that there is a dangerous bubble in U.S. financial markets.”

And in what has become his mantra when questioned about fiscal issues, Bernanke stressed the need for Congress to adopt a medium- and long-term plan to address deficits that are clearly unsustainable. He said a reasonable five-year goal would be to bring the primary budget – which doesn’t include debt repayment – down to 2 to 3 percent of GDP, which means the deficit would be growing at about the same rate as the economy. That’s the same goal articulated in the president’s Fiscal Commission plan.

But Bernanke also warned Congress not to use the debt ceiling vote when that comes up in the next month or two as a vehicle for addressing the long-term deficit problem. “I’m worried about using the debt limit as the vehicle,” he said. “If it were even the possibility that the government would default on its existing debt … we’d have to pay higher interest. That would make our deficit problem even more intractable.”

Related Links:

Bernanke Tempers GOP Criticism with Deficit-Plan Calls (Bloomberg Businessweek)

Fed Chief Warns GOP: Don’t Hold Debt-Ceiling Vote Hostage (CSM)