As Apple and CEO Tim Cook prepare to unveil the latest iPhone models Tuesday – including a rumored less expensive version with a plastic case – new data released by web research company StatCounter reinforce the global challenge the U.S. company faces, particularly from rival Samsung.

As customers waited for the release of the new iPhone models, Apple has been losing ground in the smartphone market, with its iOS accounting for 13.2 percent of worldwide shipments in the second quarter, down from 16.6 percent in the same quarter of 2012, according to the International Data Corporation. Google’s Android operating system, meanwhile, saw its share jump from 73.5 percent to 79.3 percent as shipments surged a whopping 73.5 percent amid exploding worldwide adoption of smartphones. Apple and Samsung alone accounted for all profits in the global smartphone market through the first half of the year.

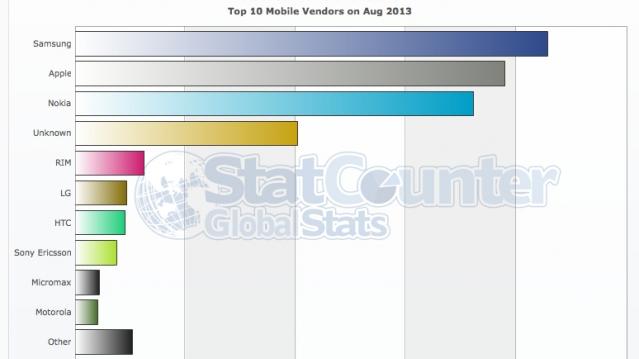

The latest StatCounter data offer a different perspective on that smartphone race. As the chart below shows, 25.7 percent of mobile internet usage in August occurred on Samsung devices, compared to 23.4 percent for Apple (and 21.7 percent for Nokia, which had been the global leader as recently as last December). Samsung overtook Apple in June, according to the tracking group, and has expanded its leadership in internet usage since then.

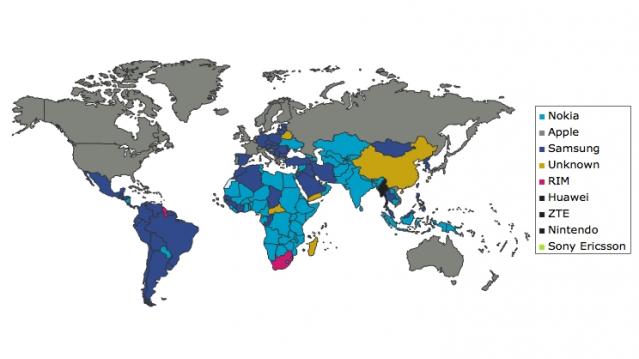

StatCounter’s world map shows the geographic stakes. Apple remains the leader in the U.S., with 52.2 percent of internet usage, compared with 19 percent for Samsung. The map shows Apple (in gray) also in a leading position in the U.K., France, Scandinavia and even Russia, where it still lags far behind Android in terms of actual market share. But other countries, especially emerging markets such as China, India and Brazil, may matter more for Apple and its plastic-backed iPhone 5C.

Apple accounts for 14 percent of mobile Internet usage in China, which is now the world’s largest smartphone market. iPhones represented just 4.6 percent of the 77 million smartphones sold in the country in the second quarter of the year, according to a research report out last week. The Cupertino company reportedly hopes to grow its market share by reaching a distribution deal with China Mobile, the largest wireless carrier in the country, with 700 million subscribers. In India, Apple devices make up a measly 1 percent of mobile Internet usage, while Nokia and Samsung are a commanding Nos. 1 and 2. In Brazil, Apple at 16 percent trails both Samsung (36 percent) and Nokia (about 19 percent). Samsung dominates most of South America, while Nokia still leads in many of the poorer countries across Africa.

The iPhone 5C could redraw that map, or at least change some colors on it. Even if a cheaper device doesn’t wow with fancy features, it can still help Apple gain ground just by combining the right mix of specs and a lower price point – though the cost of any iPhone still won’t be cheap for most emerging market customers.

Still, with Samsung winning the battle for mobile Internet users, a mid-tier phone could help Apple claw back market share, regain some leverage with carriers and keep a tight grip on app developers who might otherwise look first to the fast-growing Android ecosystem. App downloads in Google Play surpassed those for Apple’s iOS for the first time earlier this year, according to mobile metrics tracker App Annie, though downloads in Apple’s store still generated 2.3 times as much revenue. That edge in monetization, combined with a more manageable range of phones and tablets to account for, has kept Apple’s app store the prime destination for developers.

For Apple, growing the iPhone’s global market share and reversing Samsung’s expanding lead in mobile Internet users will be key to safeguarding the entire iOS ecosystem.