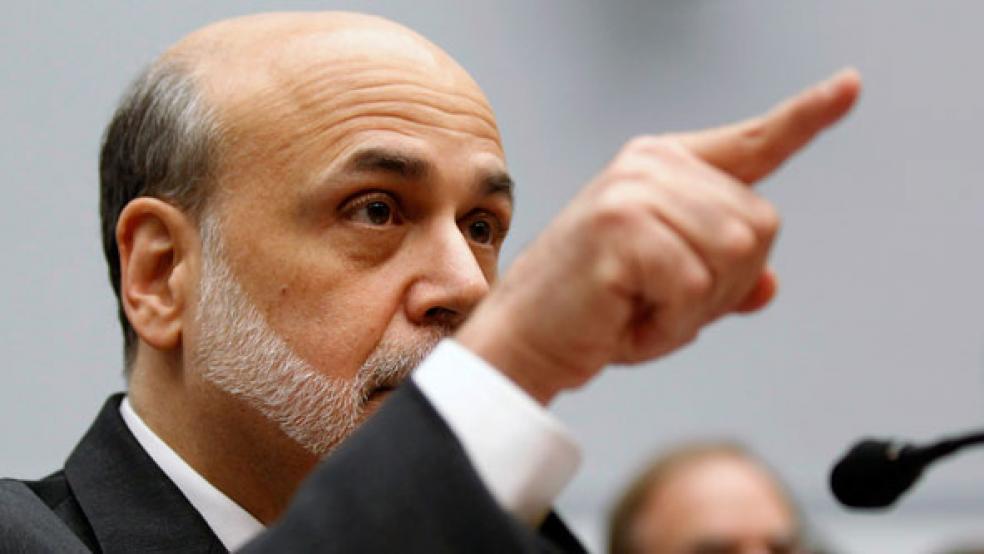

Federal Reserve Chairman Ben Bernanke had insisted for months that any decision to pull back on the central bank’s $85 billion in monthly bond purchases would depend on the economic data.

On Wednesday, anxious markets learned that he really meant it. The message came as a surprise, though, after months of signals that “tapering” was coming.

The Federal Open Market Committee, citing a recent “tightening of financial conditions” – a tightening that was caused, at least in part, by expectations of policy changes at the central bank – decided to hold off on making any changes to its bond buying program. "The Committee decided to await more evidence that progress will be sustained before adjusting the pace of its purchases," the bankers said in their statement.

Many Wall Street analysts and Fed watchers had expected the central bankers to announce a modest reduction of about $10 billion to $15 billion in its monthly stimulus, despite some bumpy economic data recently, including a weaker than expected report on housing starts this morning and disappointing job growth in August. Rates on 30-year mortgages have risen 1.2 percentage points since May, when Bernanke first raised the possibility that the Fed would ease up on its monthly bond purchases before long.

The decision leaves the Fed’s grand experiment intended to boost asset prices and economic activity – the quantitative easing that, in total, has added some $2.8 trillion to the bank’s balance sheet – unchanged, possibly until December or even 2014. It also means that, despite the Fed committee’s vision of “growing underlying strength in the broader economy,” the improvements have not yet been strong enough to make Bernanke & Co. comfortable about withdrawing any of their extraordinary support measures. The unemployment rate dropped to 7.3 percent as of last month, but largely because of a continued shrinking of the workforce that has masked some of the lingering weakness in the labor market. On the horizon, renewed fiscal battles between the White House and a fractured Congress threaten to shut down the government and disrupt the economy.

“Clearly the Fed has been spooked by the extent of the surge in long-term interest rates over the past couple of months and the impact that now appears to be having on the housing market,” economist Paul Ashworth of Capital Economics wrote in a note to clients. “We suspect officials are also increasingly concerned, as we are, that Congress could trigger a Federal shutdown within the next month.”

Bernanke had said in June that the tapering was likely to begin this year and that quantitative easing could be phased out entirely by the middle of next year, when the unemployment rate would be at 7 percent, according to Fed projections. On Wednesday, he left the timetable far more open. "Asset purchases are not on a preset course," the FOMC said in its statement, "and the Committee's decisions about their pace will remain contingent on the Committee's economic outlook as well as its assessment of the likely efficacy and costs of such purchases."

Bernanke also backed away from earlier unemployment rate thresholds of 7 percent for ending bond purchases and 6.5 percent for raising interest rates. "We are tied to the data," he said. "We don't have a fixed calendar schedule."

The decision to leave the quantitative easing program unchanged – and Bernanke's cloudy press conference comments explaining that unexpected devlopment – provided little new guidance on exactly when the Fed's policies would change, or what criteria would have to be met for the tapering to begin. That uncertainty, after months of more definite signals, calls into question the Fed's credibility with markets. "It will be hard now to take seriously Fed officials’ speeches and testimonies," wrote Ian Shepherdson, chief economist at Pantheon Macroeconomics. "Their view of the right time finally to begin the tapering of QE can be summarized thus: They’ll know it when they see it."

Bernanke and the rest of the FOMC were evidently willing to take that hit if it meant doing what they thought the economy needed, or not having to undo the taper once it had begun. And for one day, at least, investors didn't seem to mind the extended uncertainty. Both the S&P 500 and the Dow Jones Industrial Average rallied to end the day at new record highs after the Fed's surprise.

This article was updated at 7:03 p.m.