· 886,000 employed people missed work last month due bad weather. · Spending in the U.S. is growing 3.4 percent per quarter, the fastest since 2005. · Corporate profit margins are close to the $7 trillion high hit in 2006. |

U.S. workers have paid a heavy price for Corporate America’s skittishness about the economy. Uncertainty about future sales has put productivity gains and cost control uppermost in the minds of CEOs, while hiring and pay raises have been low priorities. Consequently, profit margins have staged one of the most rapid recoveries ever, and earnings have zoomed higher. For 2011, companies will have to start sharing some of the gravy with their employees. The fog of uncertainty is lifting, and companies will need more workers to meet stronger demand. That means earnings are sure to slow, but the bottom line should remain strong enough to keep investors happy.

Improvement in the labor markets is gaining momentum, although the shape of that progress was distorted by January’s brutal weather. The Labor Dept. said last Friday that payrolls increased by only 36,000 workers last month, far below the 145,000 or so expected by economists. It was also well below the gain that would be consistent with the strong advances in recently-reported January activity indexes for both manufacturing and nonmanufacturing industries from the Institute for Supply Management, in addition to the low level of weekly jobless claims.

The Labor Dept. said the number of people with jobs but not at work last month due to bad weather rose to 886,000, from 179,000 in December and the most in any January since a blizzard crippled hiring activity 1996. Economists at UBS estimate that bad weather subtracted “somewhere around 150,000” jobs from the increase in January payrolls, fueled by weakness in weather-sensitive industries, such as construction and transportation, and temporary hiring, that was far greater than in recent months.

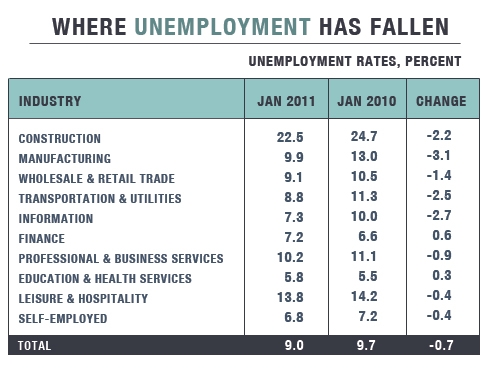

The more important surprise was the second-consecutive 0.4 percentage-point drop in the unemployment rate, to 9 percent, a level most analysts did not expect to reach until the end of the year. The Labor Dept. derives the jobless rate from a separate survey of households, which has shown much stronger growth in employment in recent months than the department’s survey of business payrolls. In coming months, economists will be looking to see if the drop in unemployment persists, “If it does,” says Michael Gapen at Barclays Capital, “it will be a further signal that underlying job growth is stronger than reported.”

Until now, businesses have been able to meet rising demand by stretching the hours worked by existing employees, hiring temps, and otherwise relying on gains in productivity to boost output. Last year’s sharp acceleration in domestic demand, including much stronger spending by U.S. consumers and businesses, is making that strategy much more difficult.

In discussing the economic outlook at the National Press Club last Friday, Federal Reserve Chairman Ben Bernanke noted the business community’s shift away from uncertainty toward better sales growth, which he said is coming at a time when companies have about exhausted their productivity gains. Over the past three quarters, U.S. spending has grown at a 3.4 percent annual rate, up from a 1.1 percent pace in the previous three quarters and the fastest three-quarter advance since 2005. Foreign demand is also strong, with exports up 8.5 percent over the past year.

Through the end of last year, businesses continued to reap big rewards from the combination of stronger demand and low labor costs. With 308 companies in the Standard & Poor’s 500 stock index having reported, 2010 fourth-quarter earnings are on a track to post a 37 percent advance from a year ago, according to Thomson Reuters. So far, 70 percent of companies have beat analysts’ expectations, well above the typical 62 percent seen since 1994. Earnings for calendar-year 2010 are set to gain about 41 percent compared to 2009.

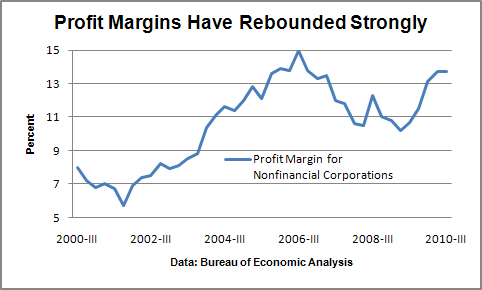

A chief reason for last year’s gangbuster earnings was fatter profit margins on the sale of each good or service. Companies boosted their margins by way of productivity gains and tight cost control. The Labor Dept. reported last Thursday that productivity, measured as output per hour, grew 1.7 percent last year, faster than the 1.5 percent rise in workers’ hourly pay and benefits. That means, adjusted for productivity, the labor cost of making a typical unit of output actually fell 0.2 percent. As a result, even a small increase in price meant that more went to the bottom line.

Based on Thomson Reuters’ expectations for fourth-quarter earnings and revenues of the S&P 500 companies, average profit margins jumped to 9.1 percent of revenues last quarter, up sharply from 7.2 percent in the fourth quarter of 2009. Commerce Dept. data for nonfinancial corporations only show that margins, which plunged during the recession, have recovered nearly back to the 40-year highs reached in 2006. With margins restored, cash flow abundant, and financing relatively cheap, companies are in a good position to expand their payrolls to meet stronger demand.

For 2011, as companies boost their work forces, earnings are bound to grow more slowly. Also, while global growth remains strong, demand abroad will not provide the pop to the bottom lines of foreign affiliates the way it did last year, when global GDP growth jumped to 5 percent, from the recession-depressed 2.8 percent growth in 2009, boosting sales. Plus, interest expense, which fell sharply in 2010, will not offer the same cost abatement in 2011. Analysts surveyed by Thomson Reuters currently expect earnings for the S&P 500 companies to rise 13.8 percent for calendar-year 2011, down from the expected 41 percent surge in 2010.

But that’s no disaster. Although profit margins are unlikely to expand much further, if at all, margins already at a historically high level funnel a handsome percentage of revenues to the bottom line. Steady margins mean that profit growth in 2011 will be increasingly dependent on gains in revenues, which are set to grow faster this year. Sales growth will reflect both stronger demand and a shade more pricing power, given that the decline in inflation appears to be bottoming out. Most economists believe that prices, even outside of energy and food, will grow a smidgeon faster than last year.

The bottom line is that jobs and profits should be a win-win for the economy this year that will both provide support for consumer spending and keep investors happy.