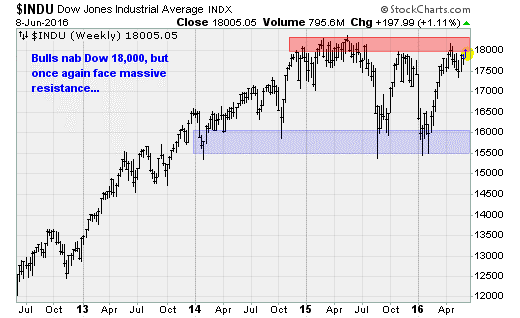

The Dow Jones Industrial Average has fallen back below 18,000 after closing above that mark on Wednesday for the first time since April. Even with Thursday morning’s slide, though, the major stock market averages are now just a few percentage points away from fresh all-time highs. An upside breakout here would put an end to a three-year-old sideways crawl that started when crude oil peaked in the summer of 2014. The weekend of Independence Day, in fact.

But one gets the feeling that we're on the verge of a breakout of a different type as stocks, by a number of measures, get dangerously expensive.

I'm talking about volatility, which went into hibernation when crude oil started to rebound back in February. Crude oil climbed above the $50-a-barrel level this week. It has nearly doubled off its February low of $26 thanks to easing inventory concerns and ongoing short-term supply disruptions in Nigeria and elsewhere.

Related: Why Oil and Gas Prices Won’t Go Much Higher

Also contributing has been a decline in Federal Reserve rate hike expectations now that action at the June or July policy meetings looks unlikely after a disappointing payrolls report on Friday.

Yet major hurdles loom — hurdles that Wall Street seems determined to ignore. These including an ongoing earnings recession, the specter of fresh interest rate hikes later this year (Fed officials have talked about two or three hikes this year vs. market expectations for one or none), and a sure-to-be-contentious U.S. presidential election.

Moreover, Wednesday's Job Openings and Labor Turnover Survey was strong, suggesting the hiring slowdown is more about a lack of qualified and willing workers rather than fewer positions needing to be filled. Job openings rose to 5.788 million for the month, beating the 5.67 million consensus estimate. The job openings rate rose to a new post-recession high of 3.9 percent.

Related: 4 Mistakes That Can Crush Your 401(k)

If so, we should see wage inflation — and thus overall inflation — start to accelerate. That could pressure the Fed to tighten policy to stay ahead of inflation. Such a move would strengthen the dollar, weaken commodities including energy and deepen the drag on corporate earnings.

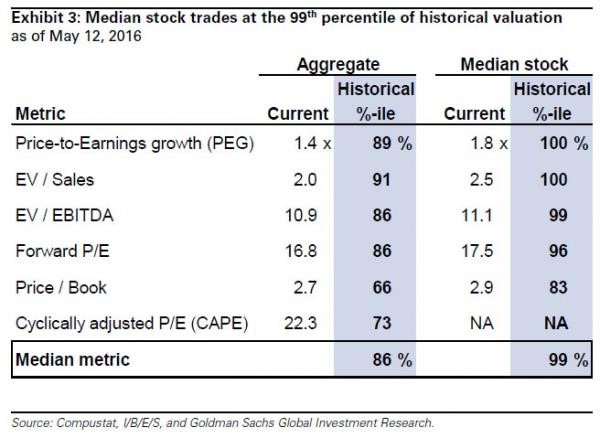

This would only worsen what are already very demanding valuation levels for stocks. By a number of measures, stocks have never been more expensive. This is a function of stock prices (which are rising) vs. profitability (which is falling). As shown above, the median stock has never been more overvalued on a price-to-earnings growth or enterprise value-to-sales measure. Enterprise value-to-operating earnings is in the 99th percentile.

Put simply: Investors are paying more for an asset of declining quality. And that has me worried.

I'm not alone, with Goldman Sachs analysts last month warning clients that stocks looked vulnerable on growth and valuation concerns. This week, Goldman strategist Christian Mueller-Glissmann warned of market "despair" and the risk of a major stock selloff as extended valuations make stocks more vulnerable to negative shocks like further declines in earnings or a surprise Fed rate hike. This is illustrated in the chart above, which shows how valuations have separated from earnings growth expectations.

Related: The US Economy May Be in Better Shape Than You Think

The S&P 500's price-to-earnings ratio is now at 16.9 vs. an average of 14.1 since 1950. Before market wipeouts of more than 20 percent, the ratio stood at an average of 16.2 and fell to an average of 12.2 at the trough of the selloff.

The timing of any market pullback will likely depend on the flow of corporate buybacks, since these have been the primary source of new money coming into stocks. Purchases have ramped up after the first-quarter earnings season. But with the Q2 reporting season looming in July, companies will be forced to quell their buying as they enter a pre-reporting blackout period at a time when Wall Street trading volumes ebb.

No coincidence then that stocks, as measured broadly by the NYSE Composite Index, have suffered July selloffs in each of the last two years after flirting with record highs in May and June.